Dubai Breaks Real Estate Records in 2025

Dubai’s real estate market has proved its detractors wrong again.

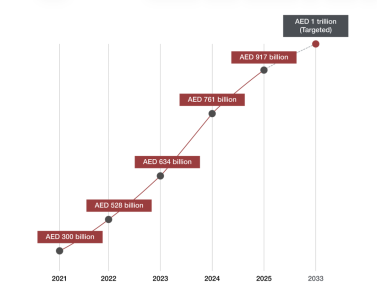

Instead of a slowdown as some analysts predicted, 2025 has overtaken 2024 as the most successful year in the emirate’s property history. With over 270,000 total transactions and a combined value of AED 917 billion, the market achieved a 19.47% year-on-year increase in volume and a 20.49% increase in value. These figures make the AED 1 trillion market value target outlined in the Dubai Real Estate Sector Strategy 2033 a near-certainty.

Sales Transactions Drive Growth

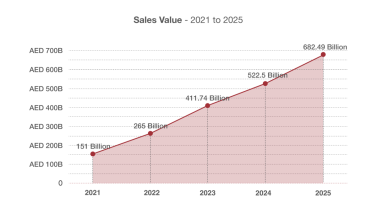

Sales activity was the dominant force behind this performance. In 2025, 214,912 sales transactions were recorded, totalling a transaction value of a staggering AED 682.49 billion. This is an 18.74% volume rise and a 30.62% value rise from 2024, respectively.

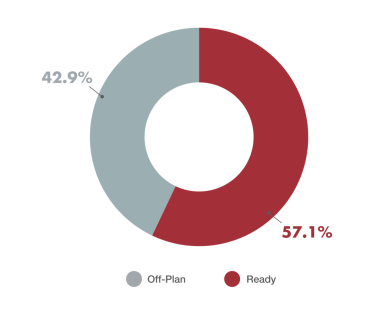

A closer look at the market reveals a balanced dynamic between ready and off-plan properties. By value, ready homes raced ahead, accounting for 57.06% of total sales value. By volume, however, off-plan sales led with 62.6%, supported by the launch of 446 off-plan projects, which were 18 more than in 2024.

Prime Market and Wealth Influx

Leading the charge in sales activity were prime segment homes (valued at $10 million and above). Dubai has become the world’s busiest prime residential market, with sales rising from just 30 such transactions in 2020 to an astonishing 500 in 2025. This segment alone generated AED 33.24 billion, marking a 27.7% increase from the previous year. Ultra-prime homes ($25 million and above) recorded particularly strong growth, too, with sales up 45% year-on-year.

The surge coincided with Dubai welcoming 9800 new millionaires in 2025, the highest influx anywhere in the world. These millionaires brought with them an estimated $63 billion in wealth. Branded residences further reinforced this trend, commanding a 64% premium over non-branded units and achieving 51% growth in value year-on-year.

Looking Ahead to 2026

As Dubai’s population surpasses 4 million, demand remains robust, with over 100,000 new homes expected in 2026. Average returns of 6–8%, flexible payment plans, blockchain-driven tokenisation and the emirate’s geopolitical stability position Dubai as a resilient, long-term global real estate hub.